Buy Low and Sell High?

I started investing in the stock market pretty heavily 19 years ago. In the early days I tried to “time the market” which consists of trying to “buy low” and “sell high.” Well, I quickly learned that it is better to “buy good companies and hold long/forever” (the approach I use today).

One of the businesses I bought low and sold high was Apple stock. I owned Apple stock at $85 per share a little over a decade ago. I sold it less than a year later for roughly $115 per share. “Yay me!” I thought, until I watched Apple stock climb to more than $1,000 per share over the next few years before a 7-1 split back down to under $100 per share and then climb right back up and then split again in a 4-1 split. (For those of you who don’t know stocks too well, a “split” is when they increase your quantity of shares, but reduce the price of the stock accordingly.) Suffice to say, a “buy and hold” approach would have resulted in A LOT of financial growth. Shame on me, but lesson learned.

As an avid stock market watcher, I started to see the correlation between stock market volatility and life volatility.

Here come my findings. (Again, stay with me till the end.)

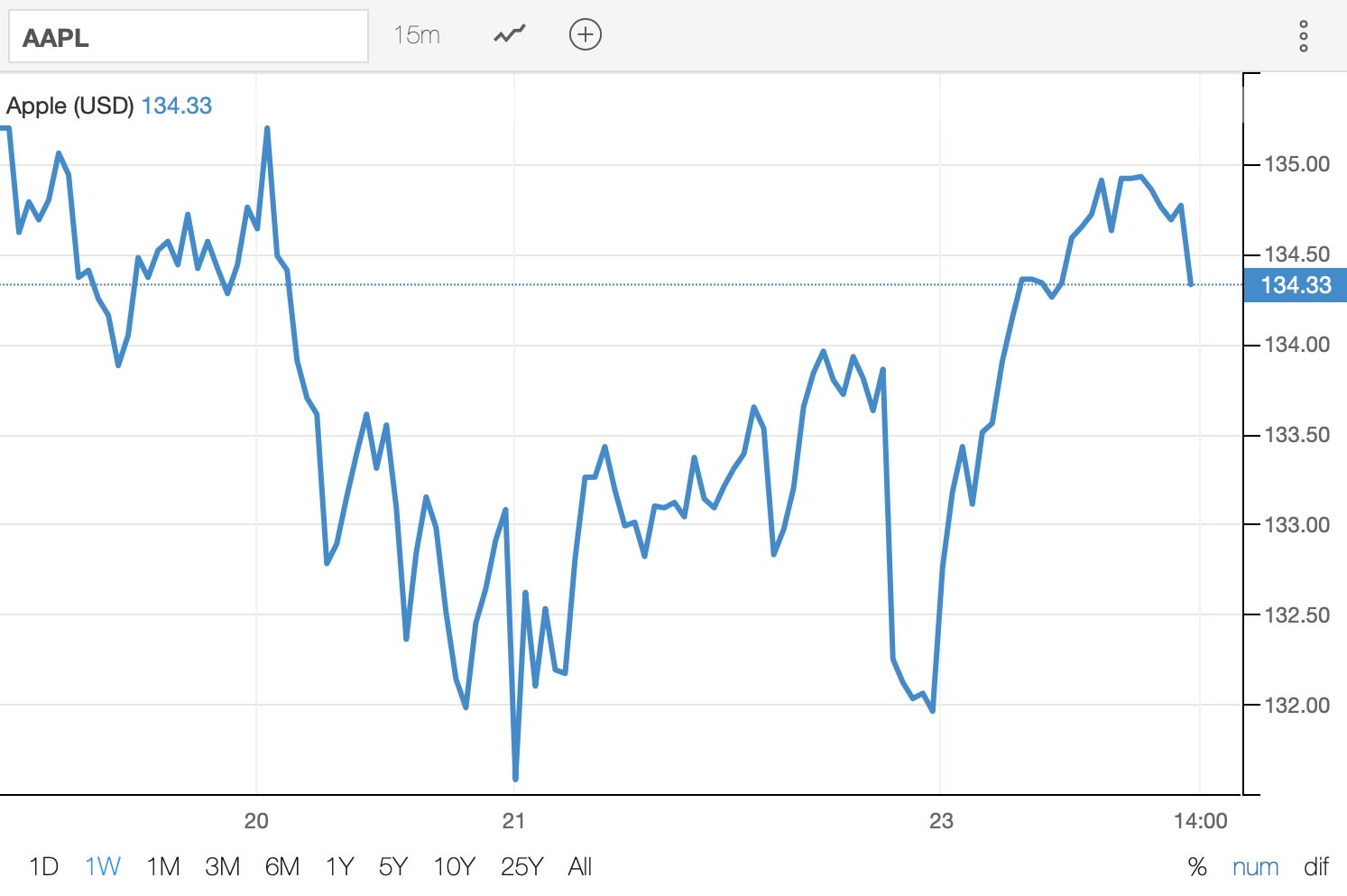

This is the 1 week stock market chart for Apple stock…

Would you buy this stock? Looks pretty risky with a lot of up and down. I probably wouldn’t buy it based on its volatile line and my investment one week ago would be worth less today.

How about this chart? This is the 3 month chart for Apple stock…

If you would have bought it 3 months ago, you would have lost money (even though it is starting to claw its way back up to the original 3 month value.

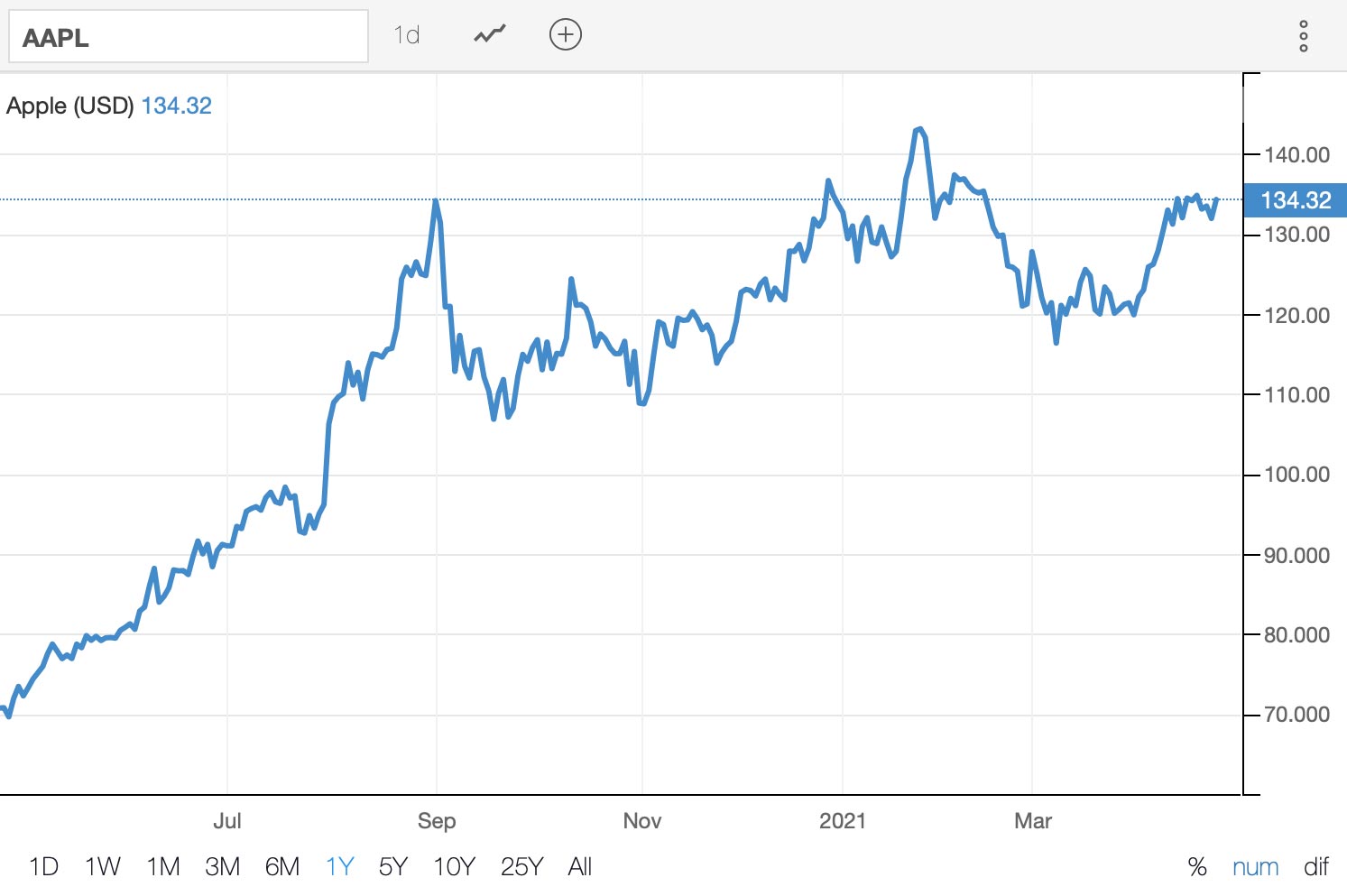

Here is the 1 year chart for Apple stock…

This chart is starting to look like a good investment even thought there has been plenty of volatility.

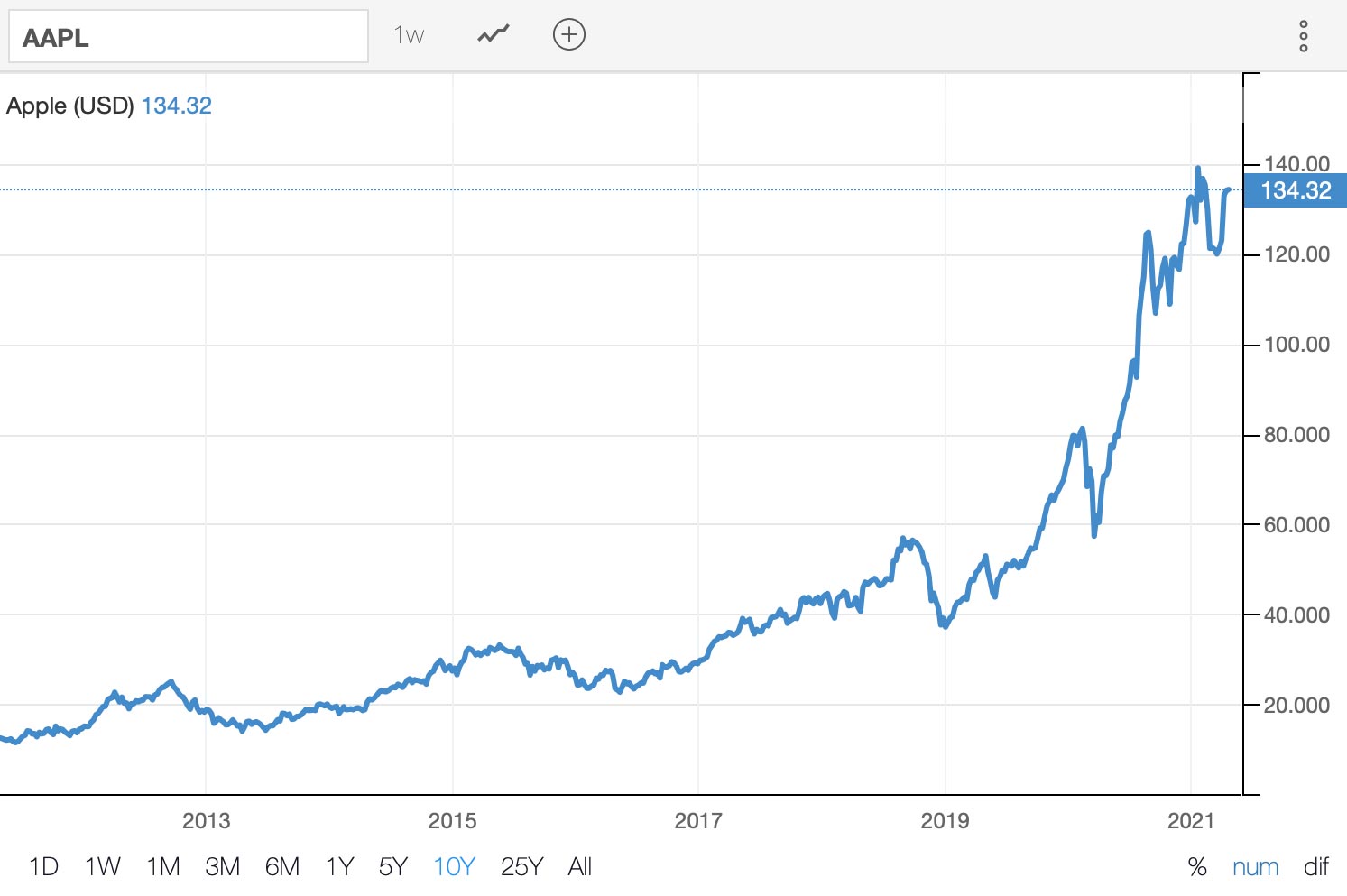

How about this one? This is the 10 year chart for Apple stock…

This is roughly what my investment would have looked like if I had held my original stock position. Ugh. You can still see a few volatile moments, but over time, most of the weekly volatility flattens out and we can clearly see the positive growth and the good investment.

Life is Like the Stock Market

Here is the lesson. Life is like the stock market. We have up weeks when everything is going great. We have down weeks when our family, friends, careers, and puppy’s lives seem to be hanging by a thread.

When those challenging weeks come, it is important to expand our perspective. Don’t look too closely at your weekly volatility. Instead expand your vision out 3 months, 1 year, 10 years, 25 years and look at your trend line. See how far you have come. Most people will see a positive trend line if they look widely enough at the timeline.

You Are a Buy and Hold Investment

Here is my final thought for today… you are a buy and hold investment. Think longterm. If you could only see where you will be in 10 years, 25 years, you would be amazed at how many great things you will accomplish in your life. So buckle up through the weekly volatility, amazing things are coming for you!